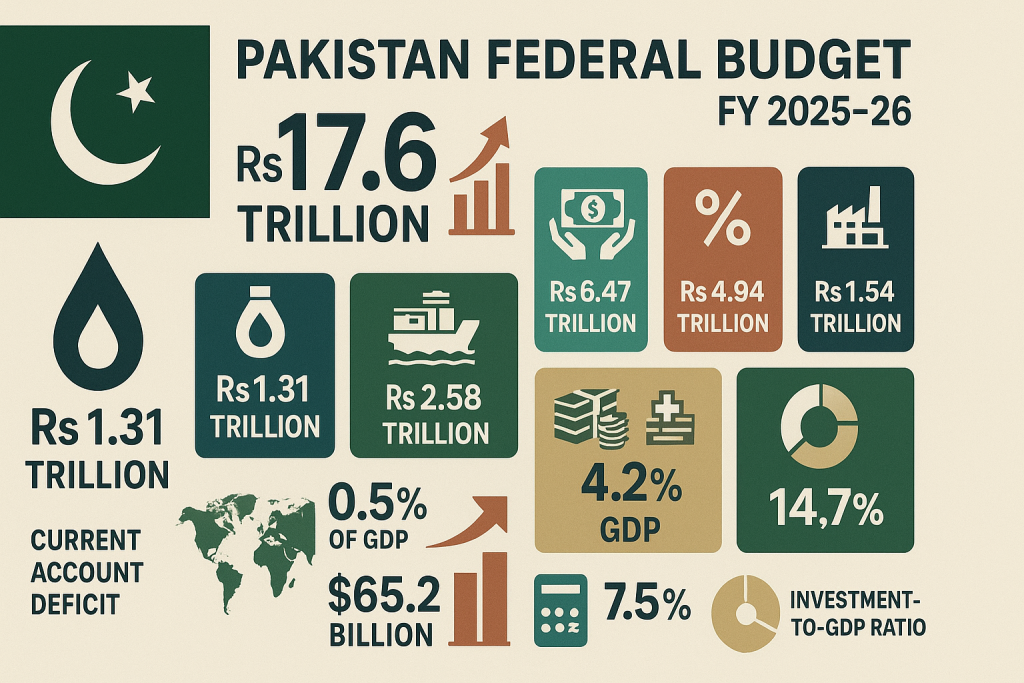

Government Sets Ambitious Rs17.6 Trillion Budget with Major Revenue and Growth Goals

Today at 4 PM, Finance Minister Muhammad Aurangzeb will present the Pakistan Federal Budget for FY 2025-26 in the National Assembly. Earlier in the day, Prime Minister Shehbaz Sharif will preside over a special cabinet meeting to approve the proposals, which include raising government employees’ salaries and pensions.

The proposed budget size ranges between Rs17.6 trillion and Rs18 trillion. Meanwhile, the Federal Board of Revenue (FBR) aims to collect over Rs14.3 trillion, broken down into:

- Rs6.47 trillion from direct taxes

- Rs4.94 trillion in sales tax

- Rs1.15 trillion through federal excise duty

- Rs1.74 trillion via customs duty

Additionally, the government expects to generate Rs1.31 trillion through a petroleum levy. While the provinces are expected to contribute a surplus of Rs1.22 trillion, non-tax revenues could reach Rs2.58 trillion.

For Pakistan Federal Budget 2025-26, the authorities have projected the current account deficit at just 0.5% of GDP or approximately $2.1 billion. They have set export targets at $35.3 billion, and imports at $65.2 billion. The services sector will also play a key role, with $9.6 billion in exports and $14 billion in imports. Furthermore, remittances are expected to hit $39.4 billion, pushing total exports of goods and services to $44.9 billion, against total imports of $79.2 billion.

On the growth front, the government targets a 4.2% GDP increase and aims to keep average inflation at 7.5%. With fixed investment at 13%, private investment at 9.8%, and public investment at 3.2%, they have also budgeted for an investment-to-GDP ratio of 14.7%. It is anticipated that national savings will amount to 14.3% of GDP.

Government Spending, Sectoral Growth Goals, and Significant Policy

Industry, Agriculture, & Services to Drive Economic Expansion

The government has established growth goals to support agriculture for:

- Major crops at 6.7%

- Other crops at 3.5%

- Livestock at 4.2%

- Forestry at 3.5%

- Fishing at 3%

Within the industrial sector, they strive for:

- 4.7% manufacturing growth, which includes:

- 3.5% for large-scale manufacturing

- 8.9% for small-scale

- 4.3% in slaughtering

- 3.5% in electricity, gas, and water

- 3.8% in construction

Additionally, the services sector will grow, with the following growth objectives:

- 3.9% in wholesale and retail trade

- 3.4% in transport and communication

- 5% in information and communication

- 5% in financial services

The Government Plans Major Borrowing and Allocates Rs8.7 Trillion for Debt Servicing

The government has allocated Rs8.685 trillion to debt servicing and Rs2.414 trillion to defence. The Public Sector Development Programme (PSDP) will receive Rs1.065 trillion. To support these expenditures, officials plan to secure Rs6.588 trillion in fresh loans.

Over $25 billion could be borrowed overall, with $12 billion coming from rollovers from important allies like China, Saudi Arabia, and the United Arab Emirates.

- $4.6 billion for project financing

- $2 billion from the IMF

- $1 billion in commercial loans from China

Employee Benefits and Public Relief Measures to Combat Inflation

The government has reviewed three proposals regarding public sector salaries and pensions. Among them is a 30% disparity allowance for employees in Grade 1–16, and a 10% increase aligned with inflation. The final decision will come during the cabinet meeting.

Meanwhile, officials may exempt the armed forces from the contributory pension scheme. In an effort to lower household power consumption, they also intend to introduce a public program that will distribute energy-saving fans through electricity bills.

Improved retail surveillance, tax reforms, and industrial incentives

EV Policy and Duty Cuts on Raw Materials to Support Industry

The budget suggests the following measures to encourage local manufacturing and reduce production costs:

- Remove the Additional Customs Duty (ACD) from 4,294 tariff lines, the majority of which are for raw materials.

- Lower taxes on more than 7,000 intermediate and raw material products

Furthermore, the government plans to support domestic production of batteries and chargers for laptops and smartphones.

In an effort to promote cleaner energy, the authorities propose a five-year levy on petrol and diesel vehicles. This measure could generate Rs122 billion to fund the upcoming Electric Vehicle Policy 2026–30.

FBR Will Encourage Whistleblowers and Increase Retail Monitoring

The FBR will improve its retail industry surveillance by:

- Raising the fine for POS-registered retailers who evade taxes from Rs500,000 to Rs5 million

- Expanding the number of POS-registered retailers from 39,000 to 700,000

- Using field workers and surveillance cameras to improve compliance

The government will reward whistleblowers who assist in identifying tax evaders with rewards ranging from Rs5,000 to Rs10,000 in an effort to promote reporting.