SBP Forecasts Rs. 2.4 Trillion Profit for FY25

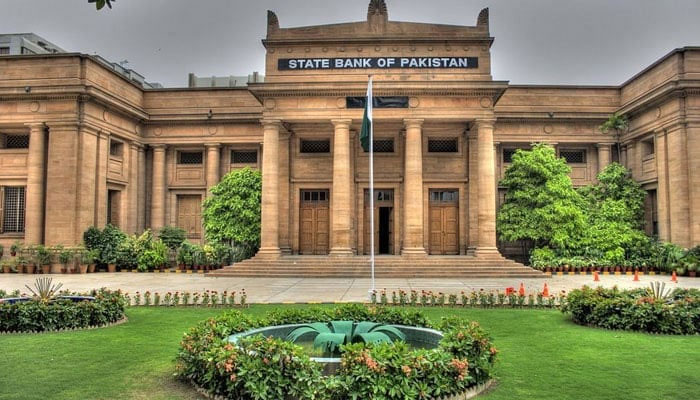

SBP profit FY25 The State Bank of Pakistan (SBP) is set to report a profit of Rs. 2.4 trillion for the fiscal year 2025, aligning with the federal government’s target. According to SBP Governor Jameel Ahmed, this gain stems from robust interest income and favorable foreign exchange movements.

Governor Ahmed shared the details during a press briefing on Monday. He confirmed that after completion of the annual audit and board review, the entire profit will be handed over to the government at the beginning of FY26.

Policy Rate Maintained Amid Inflation Risks

The SBP has kept its key policy rate steady at 11 percent, citing ongoing inflationary pressures and global uncertainties. Despite slight improvements in macroeconomic indicators, the central bank has taken a cautious approach.

The SBP remains optimistic about reaching the 4.2 percent GDP growth target for FY26, though it acknowledges the challenges. The expected economic rebound in industrial and services sectors will be crucial to achieving this objective.

External Debt and Reserve Management

For FY25, Pakistan’s total external debt repayments stand at $25.8 billion. Only $400 million remains pending, which the SBP plans to settle within the next two weeks. A similar level of repayment is projected for the upcoming fiscal year.

Record Remittance Forecasts and NIR Target

The State Bank of Pakistan (SBP) expects remittances from overseas Pakistanis to climb to $38 billion in FY25, a significant jump from $31.3 billion in the previous fiscal year. This remarkable increase will directly ease pressure on the current account and strengthen external financial buffers.

Furthermore, Governor Jameel Ahmed confirmed that the SBP already exceeded its Net International Reserves (NIR) target for December 2024. Moreover, the central bank remains confident that it will successfully meet the June 2025 target as well.

Temporary Liquidity Adjustments

In addition, the SBP reported a temporary increase in Open Market Operations (OMOs). It linked this rise to Eid-related currency demand and short-term mismatches between foreign inflows and debt repayments. However, the central bank assured that it is actively managing these liquidity movements to ensure market stability.

Conclusion

By maintaining robust profits, stable reserves, and record-breaking remittances, the SBP demonstrates its ability to navigate economic uncertainty. It also positions itself to support sustainable financial resilience throughout FY26 and beyond.