In the early hours of Friday, June 13, Israel launched airstrikes targeting Iran’s command centers, missile bases, air defense systems, and nuclear facilities. These strikes, part of the ongoing Israel-Iran conflict, killed several Iranian military leaders and nuclear scientists. Israel stated this campaign could span days or weeks. This escalation raises questions: How will Iran retaliate? Will the United States get involved? What impact will this have on global oil and tanker markets?

Iran’s Immediate Response: Drone and Missile Attacks

Iran retaliated by launching drone attacks on Israel, but most were intercepted with minimal damage reported. Subsequently, Iran fired ballistic missiles. Analysts suggest Tehran will escalate to preserve domestic credibility, but their options are limited. Israel’s strikes have significantly reduced Iran’s capacity to mount effective counterattacks.

The Role of Iran’s Proxies

Iran’s regional proxies, including Hamas, Hezbollah, and militias in Iraq, have been weakened over recent years. Additionally, the collapse of the Assad regime in Syria, an ally of Iran, has further limited Tehran’s strategic reach. Although these proxies might attempt isolated attacks, their diminished capabilities reduce their effectiveness against Israel.

Strategic Options for Iran

Despite setbacks, Iran has potential avenues for retaliation:

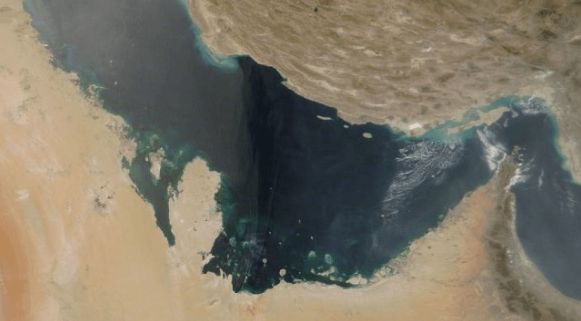

- Closing the Strait of Hormuz: This waterway facilitates over 20% of global oil shipments. Disrupting it could spike energy prices and disrupt economies.

- Targeting Oil Infrastructure: Attacks on regional oil facilities could destabilize markets but might alienate neighbors and escalate tensions further.

- Striking U.S. Bases: Targeting American forces could provoke a strong military response.

Each option carries risks, including harm to Iran’s energy infrastructure and further economic isolation.

Impact on Global Oil and Tanker Markets

The Israeli strikes caused immediate fluctuations in oil prices and tanker rates. Heightened geopolitical tensions and potential supply disruptions drove oil prices higher. Tanker rates, particularly for Very Large Crude Carriers (VLCCs), also increased, reflecting heightened risks in the Arabian Gulf.

Oil Market Dynamics

Global oil markets remain well-supplied with robust inventory levels. However, Iranian oil exports, already forecasted to decline by 400,000-500,000 barrels per day in the coming months, face heightened risks. Chinese independent refiners, key buyers of Iranian oil, may seek alternative sources, increasing demand for discounted Russian crude or other Middle Eastern supplies.

Tanker Market Reactions

Tanker rates for the Arabian Gulf-East VLCC route rose from WS43 to WS55 after the strikes. Although significant in percentage terms, the market remains subdued due to seasonal factors. Historically, conflicts in the region have caused charterer panic and shipowner reluctance to enter high-risk areas, leading to dramatic rate hikes. Currently, tanker activity remains stable, but this could change if the conflict escalates.

Lessons from Previous Conflicts

Past Middle East conflicts offer insights into potential outcomes. Initial spikes in oil prices and tanker rates often stabilize unless supply disruptions persist. The current situation mirrors these patterns, with markets responding cautiously without entering a full-blown crisis.

Potential U.S. Involvement

The likelihood of U.S. intervention hinges on the conflict’s trajectory. Any Iranian move to close the Strait of Hormuz or target American assets could prompt U.S. involvement. The United States maintains a significant regional military presence, ready to respond to threats against its interests or allies.

Conclusion: Uncertain Path Ahead

The Israel-Iran conflict introduces uncertainty into global markets and geopolitical stability. Israel’s strikes have weakened Iran’s military capabilities, but Tehran’s responses could escalate tensions. The impact on oil prices and tanker rates will depend on whether the conflict disrupts energy supplies or remains localized. Stakeholders worldwide remain on high alert, monitoring developments in this volatile region.